Crypto Dundees Bitcoin analysis: Will the Bitcoin bull market start in november?

In our first technical analysis for BitcoinMagazineNL, we’ll be looking at the longterm Bitcoin trend. Bitcoin has been in a bear market since the beginning of 2018, but sentiment is shifting bullish. Unfortunately, we’ve been seeing bullish sentiment at every peak, after which prices started tanking again. Hype and FOMO can be a big danger to your portfolio, so we’ll try to filter out the noise and actually look for important levels to keep an eye on. In this analysis we’ll first take a look at the current situation from a birds eye view and zoom in as we go.

Zoomed out

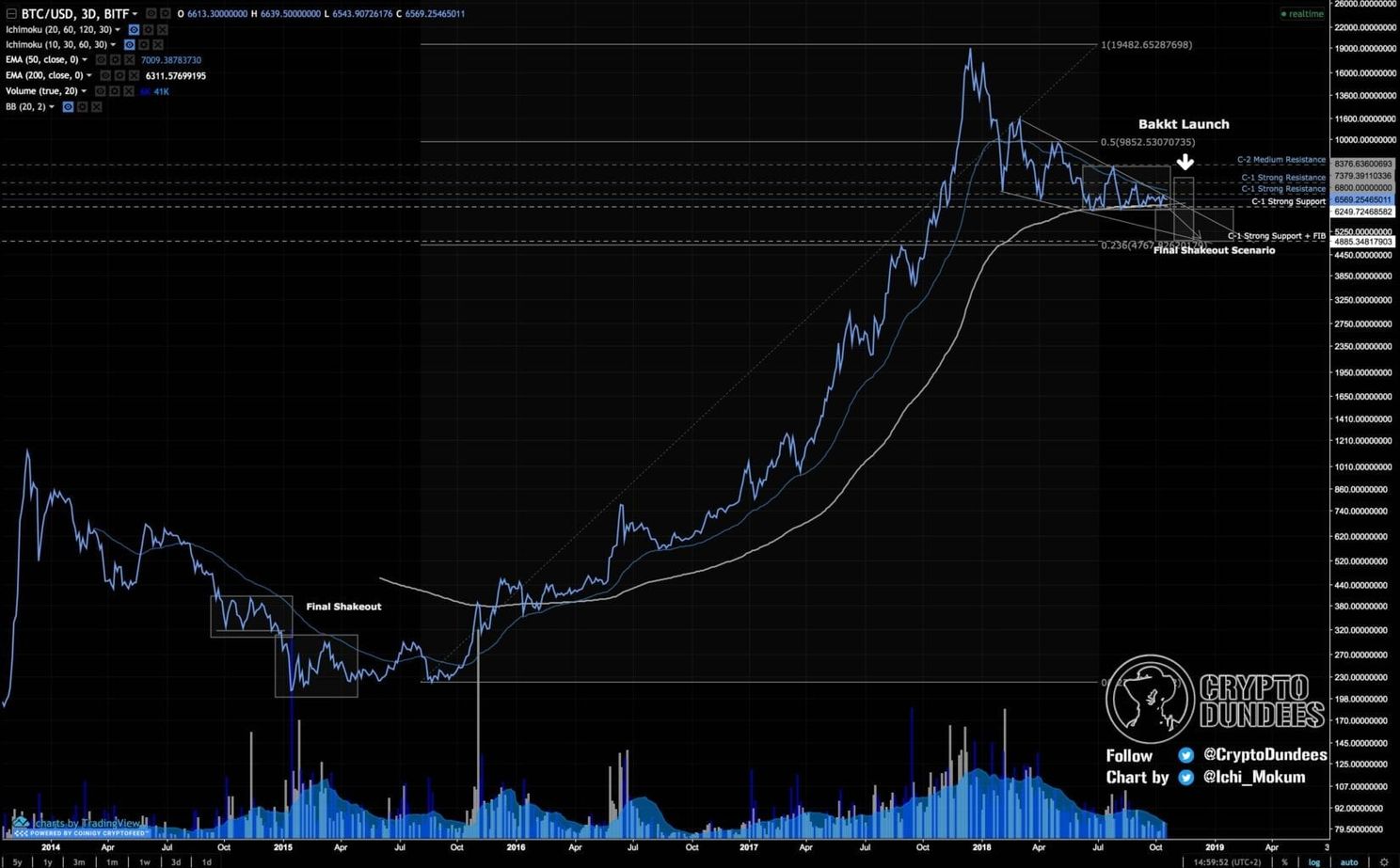

We’ll start by looking at the 3D timeframe on a line chart to filter out panic and FOMO wicks and look for strong resistance, support and trend lines.

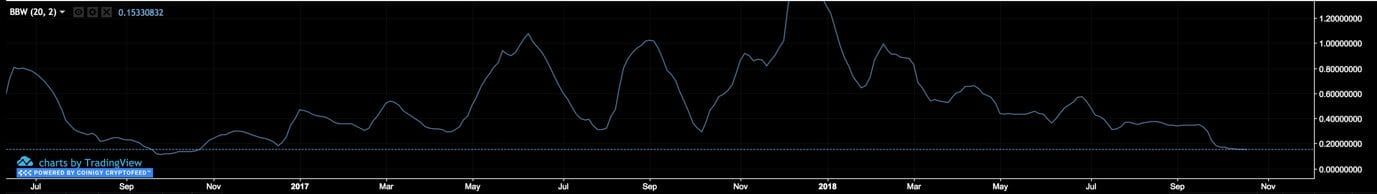

The first thing that should grab your attention from the chart below, is the 200 and 50 EMA. In recent months, the 200 EMA has been a very strong support with prices bouncing up every time as they hit the 200 EMA. Correspondingly, the 50 EMA has acted as a very strong resistance, resulting in the tightest BBand squeeze since October 2016 as indicated below:

With BBands being this tight, a breakout either way, will result in a very strong move. At this point, it’s fair to say that a 3D close above or below one of these EMA’s would correspondingly result in an all out bull market or final capitulating shakeout.

Zoomed in

When we zoom in, we can easily identify the current trading range, currently, we’re at the middle to upper part of the trading range. Longing or shorting here is a bad idea. The most important level on this chart, would be the $6300 level for multiple reasons.

A long from this level with a stop-loss below $6200 would be a pretty decent set-up. A close below $6200 would be a clear indicator to go short. Now let’s first look at the case that can be made for a final shakeout/capitulation, followed by the case of a bull market.

Final Shakeout Scenario

A case for this scenario can be made for several reasons:

A final shakeout would most likely result in an extended period of consolidation, with prices ranging between $4500 and $6300, similar to what happened at the start of 2015. If a final shakeout would occur, we expect $4500 being the bottom. Around $4500 there’s strong horizontal support, fib level 0.236 and a long term downtrend line starting February 2018. Bulls will defend these levels with their lives.

That being said, as with hype, fear is much stronger in the crypto market than traditional financial markets, we wouldn’t be very surprised if we took a dive all the way down towards approximately $3000,-. We expect prices around $3000,- being bought up instantly by institutional investors. And that is also one of the arguments that could be made for a bull market starting in November.

Bullish Scenario

Thankfully, there’s also plenty arguments to be made for a bullish outlook.

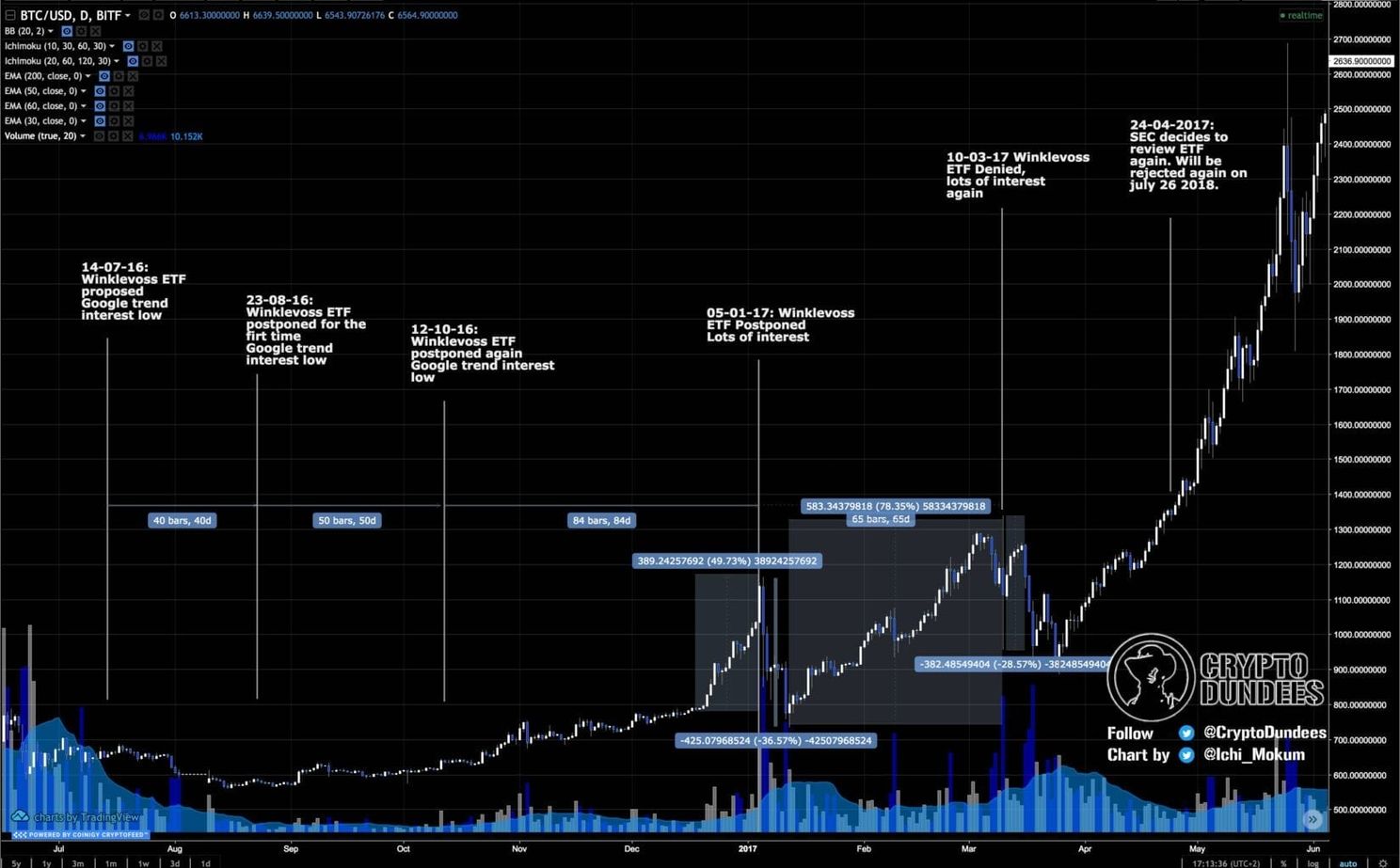

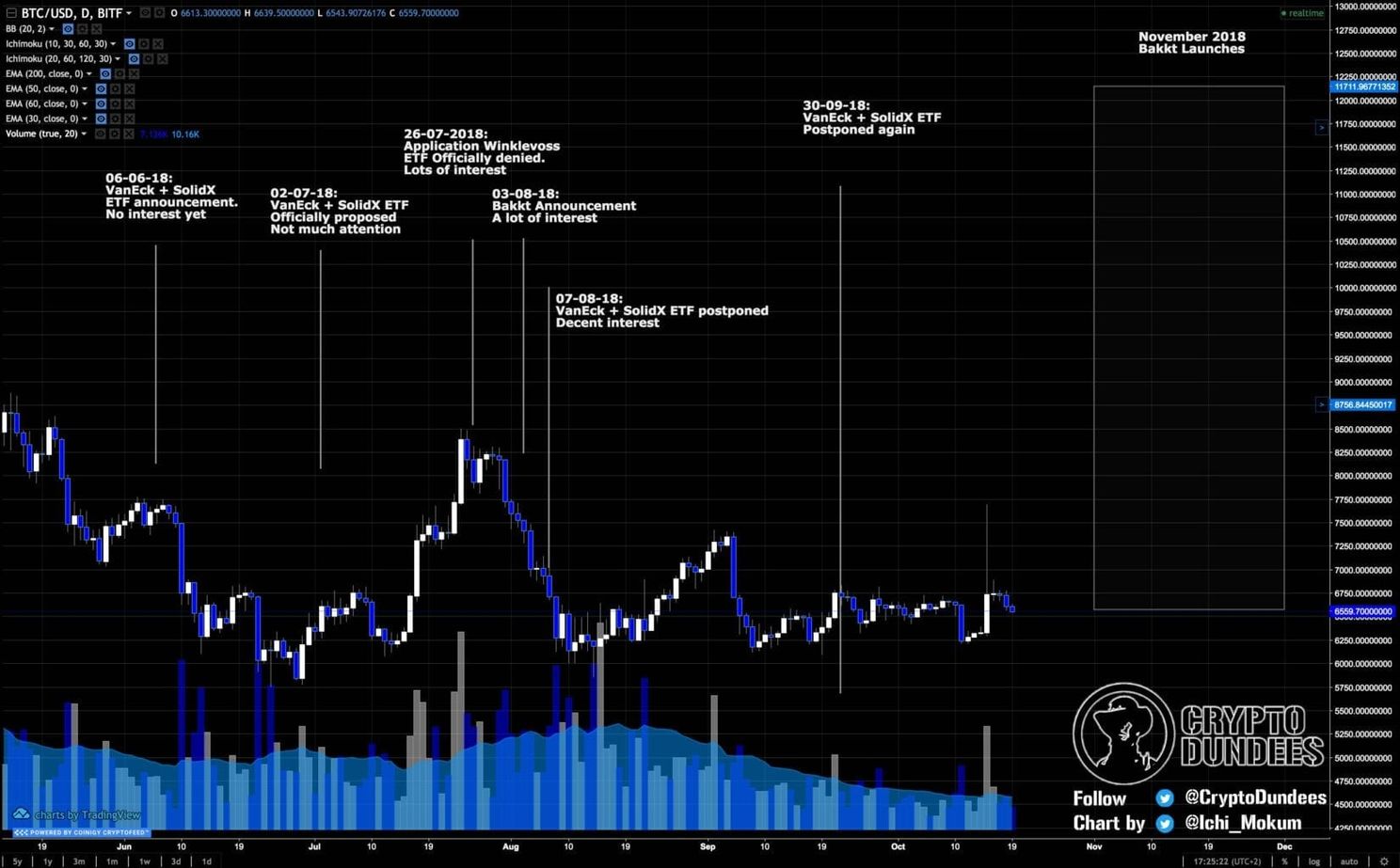

Bakkt

In all of 2017 and 2018, the crypto market has been waiting for an ETF approval. An ETF would act as a gateway for institutional investors to start investing in Bitcoin. Especially in 2017, we’ve seen strong run ups towards ETF decision dates and strong declines in prices after they were postponed. We used Google Trends to indicate the amount of hype around these decision dates and we’ve found strong correlations between hype and price action. This is all indicated in the chart below.

This charts indicates a strong correlation between Bitcoin ETF decisions, google trend interest and price action.

Bitcoin ETF’s

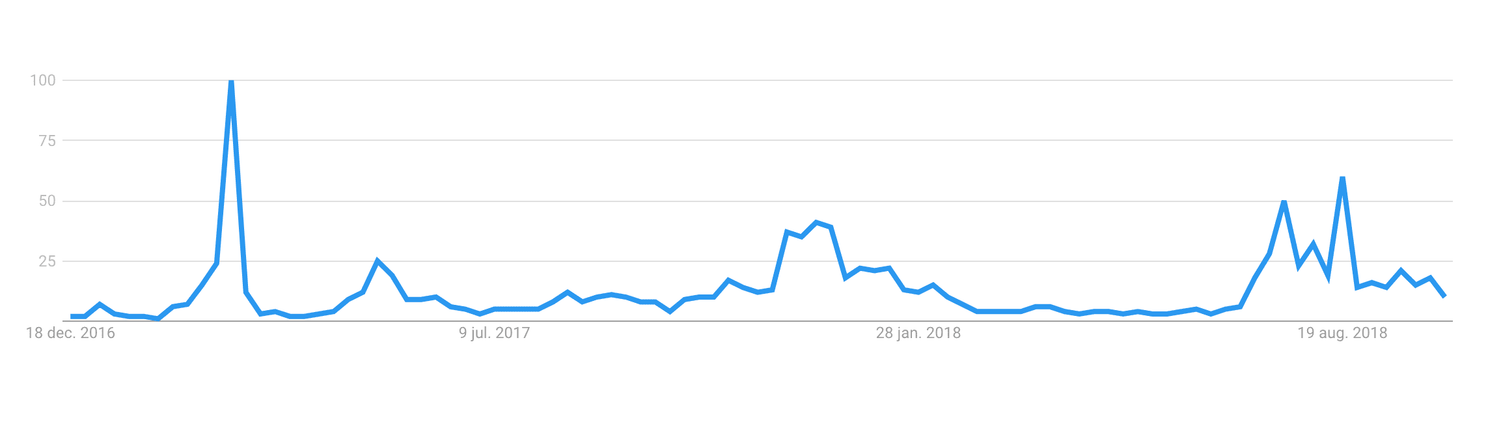

In 2018, interest in Bitcoin ETF’s never reached the hype of 2017:

One reason for decreased interest, is that no one actually believes an ETF will be accepted before February/March 2019, the other reason is the fact that Bakkt will launch it’s “physically” backed Bitcoin exchange in November. This doesn’t only allow institutional money to flow in easily, it can also help an ETF being approved in the future. When looking at Google Trends again, we see a growing interest in Bakkt as we start approaching launch.

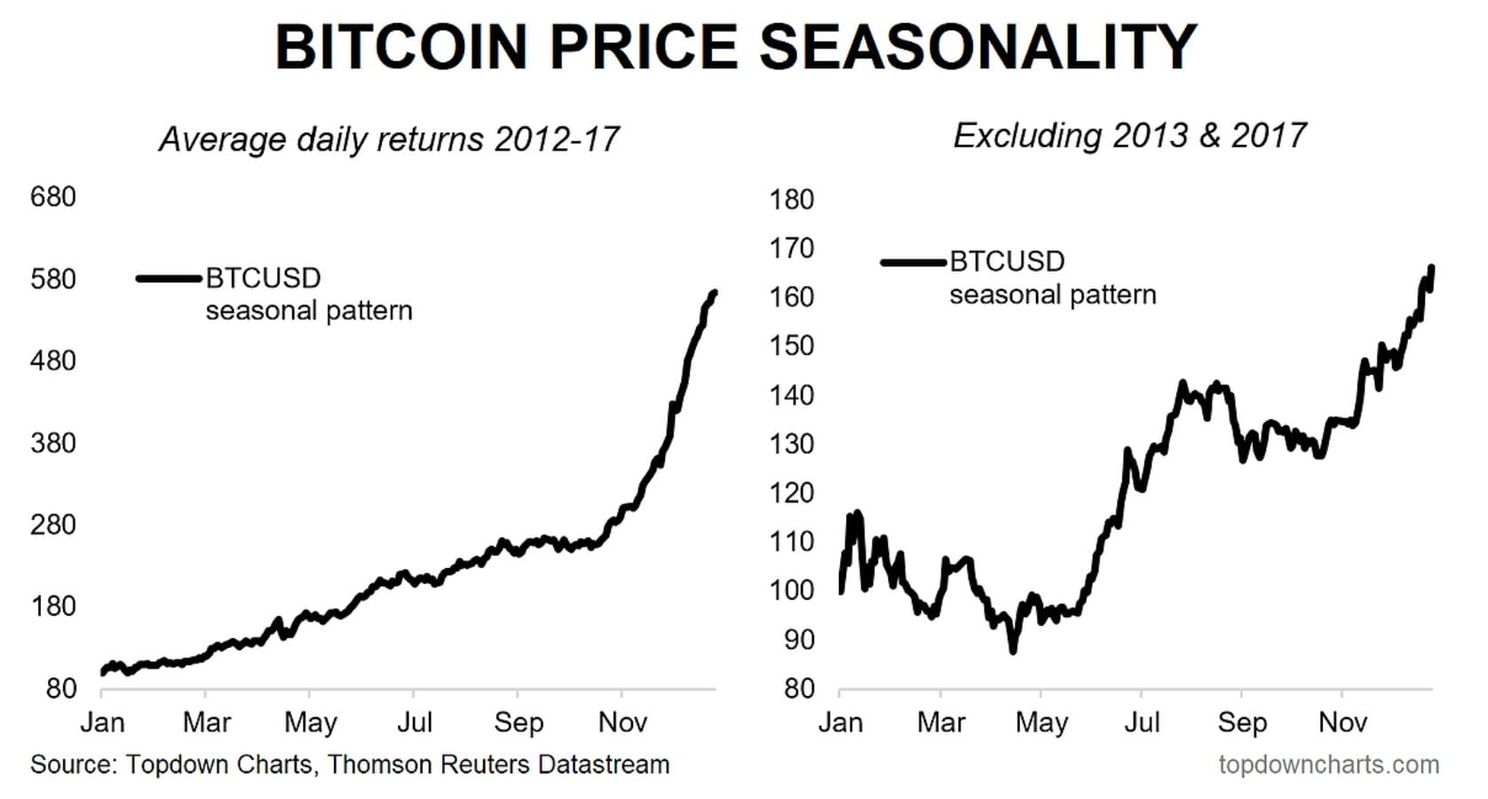

Bitcoin Season in Q4?

Bitcoin Season in Q4?

Another indicator for a bullish trend reversal is simply seasonal, as indicated below. Even without the excessive bull runs of late 2013 and 2017, November and December have always been very bullish for Bitcoin. Obviously, there is no guarantee that history will repeat itself, but it’s something to keep in mind.

Summary

2018 has been a very tough year for Bitcoin and crypto in general. We think it’s too soon to tell whether the end of the bear market has approached, or if a final shakeout will still occur. Although it’s a very unpopular opinion, we’re leaning towards bearish continuation, but we’ll be keeping an eye on price action and take it from there.

If capitulation does commence as described before, this would mean a decrease in value of at least 25% for Bitcoin. Imagine what this would mean for altcoins and your portfolio if you’re all in on crypto. If Bitcoin and therefore crypto will start a bull run, there will be plenty of time to enter a good position later on. We are currently 25% in crypto and 75% in fiat, not only to save our portfolio, but because we see strong buying opportunities if capitulation does occur. We don’t want to be too greedy just yet and use our greed to reserve some fiat to buy the capitulation, imagine the buying opportunities when Bitcoin starts breaking down here. Remember that a 25% decline is a 33% profit if you buy the bottom.

About the author:

Disclaimer: the content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.